Pill Text

Pill Text

Pill Text

Pill Text

⭐️ Welcome back to another edition of the Tax Tea, your go-to source for all things taxes, served piping hot. In this edition, we're diving into the IRS's massive upgrade and what it means for you, challenging the wisdom of ChatGPT, the "need to knows" on property taxes, and taking a look at the varying landscape of Social Security taxes across the states.

WHAT'S STEEPING NOW

🇺🇸 The IRS, after a decade of budget cuts and operational challenges, has the support to make taxes easier for everyone.

💻 Just because ChatGPT is honest, doesn't mean it’s always telling the truth.

🤔 While federal taxes on Social Security are generally unavoidable, state taxes can vary significantly based on where you live.

🏠 Property taxes aren't the most enjoyable way to spend your hard-earned money, but understanding how they benefit you could help ease the burden.

PIPING HOT TEA

An $80 Billion Tax Upgrade That Could Change Everything

Over the past ten years, budget cuts have strained the IRS's operations, reducing its ability to audit tax returns, provide quality customer service, and update its technology. Thankfully, the government was just given a hefty budget to improve its operations. These improvements will facilitate better access to interact with data, improving the tax landscape for taxpayers and tax software providers.

TL;DR

- The IRS received $80 billion from the Inflation Reduction Act in 2022 to resolve issues like backlogs and staff shortages and to modernize its systems.

- The IRS has to release a strategic plan that details how it will effectively use the funds over the next decade.

- The IRS plans to launch an improved digital portal with better user visibility and control.

- The new portal will enable online tax filing, tracking of audit statuses, and quick responses to IRS notices.

- The portal will also provide timely updates on changes in tax laws and help taxpayers identify applicable credits and deductions.

- IRS communications will be simplified and translated into eight different languages to cater to a diverse range of taxpayers.

Click here to read more

THE SOCIALLY TAXING

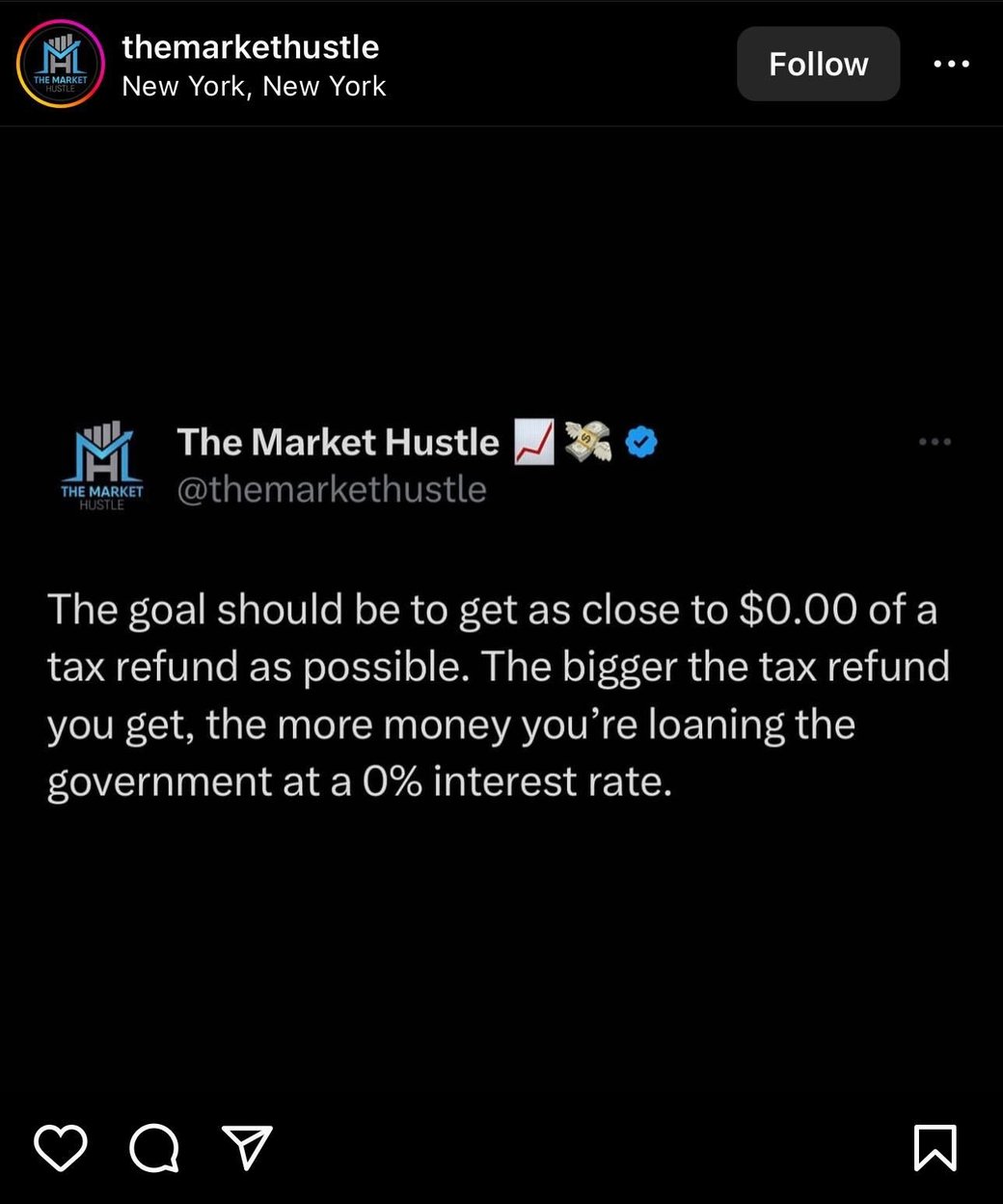

(Source: @themarkethustle)

This content is provided for informational purposes only and should not be construed as tax, legal, financial, or other professional advice. Rules and regulations vary by location and are subject to change, so please consult with an expert if you need specific advice. Copyright Disclaimer under section 107 of the Copyright Act of 1976, allowance is made for “fair use” for purposes such as criticism, comment, news reporting, teaching, scholarship, education, and research.

Tax Across the Web

Retirement Daily posed a question to ChatGPT about the tax impact on Social Security benefits in relation to RMDs, passive, and active income. Unfortunately, an expert confirms that the well-loved chat bot isn’t so perfect.

(source: Retirement Daily | The Street)

Social Security tax laws differ drastically across states. While federal taxes on Social Security are often inevitable, state taxes are avoidable depending on your location. Yes, there are ways to avoid taxes legally.

(source: Bram Berkowitz | The Motley Fool)

Property tax, an inevitable part of homeownership, can be a complex topic. Its value depends on the location and assessed value of the property, and can change over time. This unravels the somewhat mysterious nature of property tax.

(source: Katelyn Washington | Kiplinger )

Related Content

Related Content

Related Content

Related Content

There's more where this came from