Pill Text

Pill Text

Pill Text

Pill Text

Taxes are a part of our everyday life and influence every big financial decision, but it's the unexposed iceberg submerged within the ocean of personal finance. We're using culture and technology to shed light on taxes in a way that feels easy to digest and relevant.

Taxes don't have to feel cold. Together, we'll explore this ocean with piping hot tax tea.

WHAT'S STEEPING NOW

🏛️ A recent legislative change with a price tag of $1.7 trillion is packed with retirement adjustments.

🌴 Don’t move to Florida to save money on taxes without looking at the bigger picture.

✈️ If you plan on having money overseas, make sure you know what an FBAR is.

🏠 Going green in your home can save you money on your taxes.

PIPING HOT TEA

$1.7 Trillion in Tax and Retirement Changes

Student loan concerns fear not!

Many people who have to make student loan payments can now get matching contributions into certain retirement funds.

Increasing contribution limits

If you're above 50, congress increased how much you can add to your IRA annually.

Penalty-free withdrawals

Some people will have emergency plans built into their IRA, making it easier to withdraw emergency money without a penalty.

Automatic enrollment into retirement plans

People will be eligible for 401k plans earlier than ever with their employer; you can start saving a little faster.

Modification to SIMPLE IRAs to accept Roth contributions

Companies can now match Roth IRA contributions, meaning your employer can match your post-tax contribution to your IRA.

Online lost and found for long-forgotten pension benefits

If you've ever misplaced information to a 401K, they're creating a lost and found network to help you find it.

Expanded Savers Credit

They just expanded who will qualify for the savers' credit, meaning more people can save money on their taxes by contributing to their retirement.

What’s the news on the child tax credit?

The child tax credit was not included in this bill, so families will have to wait and see if they’ll get anything additional this year.

Click through to read the full article.

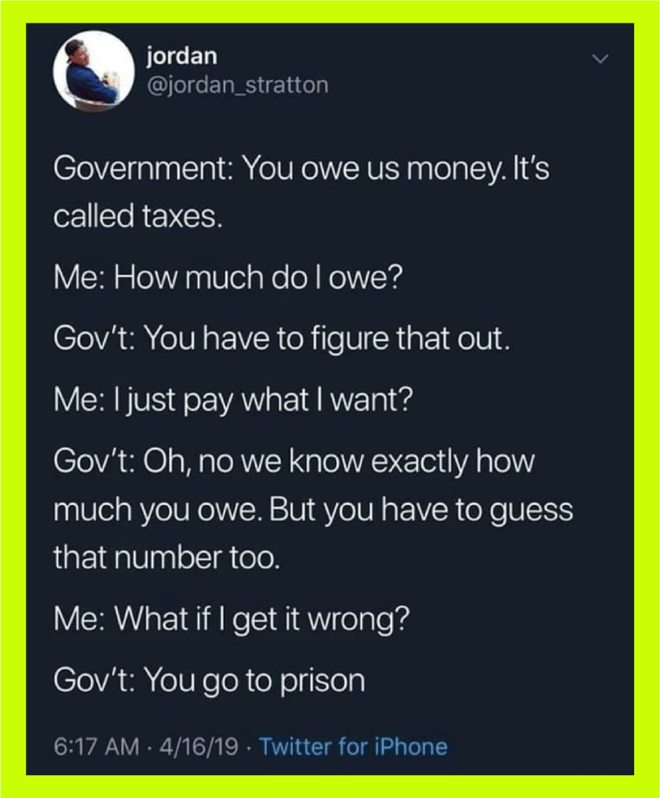

THE SOCIALLY TAXING

(source: Jordan Stratton on Twitter)

This content is provided for informational purposes only and should not be construed as tax, legal, financial, or other professional advice. Rules and regulations vary by location and are subject to change, so please consult with an expert if you need specific advice. Copyright Disclaimer under section 107 of the Copyright Act of 1976, allowance is made for “fair use” for purposes such as criticism, comment, news reporting, teaching, scholarship, education, and research.

Tax Across the Web

Just when you thought your tax experience was a horror story worth telling at dinner parties, you get one-upped. These people had to go through the wringer - for being honest.

(source: William Baldwin | Forbes)

A lot of people signed up to move to Florida for the savings, but some didn’t read the fine print. Taxes might be low in the state, but the cost of living is offsetting some of the advantages.

(source: Jacob Zinkula | Insider)

You might have to spend a little money to save a little money, but your home will thank you for putting it on an energy diet. You can save money on your taxes when you go green at home.

(source: Rebecca Leber | Vox)

Related Content

Related Content

Related Content

Related Content

There's more where this came from