Pill Text

Pill Text

Pill Text

Pill Text

💐Welcome to the first March edition of The Tax Tea. As we hopefully bid farewell to the winter blues and welcome the warmer days just around the corner, we hope you still have room for tea! This edition is about the future, from understanding what taxpayers want to IRS modernization. So let's celebrate what's coming next with a "Sip, sip, hooray!"

WHAT'S STEEPING NOW

😍Check out this first-party data on how people feel about tax filing software and prep services.

🌐The IRS is taking steps toward modernization, and it’s starting with something as simple as digital uploads.

🚀The IRS has received more and has processed tax returns this year compared to the last.

💃 Before you dance over to tik-tok for tax advice, see what some experts have to say about the information being shared on the app.

PIPING HOT TEA

The American Taxpayer Report

The State of the American Taxpayer has been released, and it examines how people approach tax filing software and preparation services. The survey of 4,621 Americans highlights the desire for year-round tax engagement, a priority for data accuracy and privacy, and a willingness to tackle the inequities of the tax system. It's all about the future of tax innovation and how embedded tax, a hot new fintech category could provide the solutions people want. If you're a CEO, CPO, or Product Manager, you need to read this thing yesterday.

TL;DR:

There is a willingness to try new products: 26% of all respondents said that nothing would prevent them from trying a new tax product.

People want to spend more time, not less on their taxes: 41% put estimation and guidance along the way in their top 3 most important needs (ahead of less time spent).

People are willing to spend $$ for data accuracy and confidence: The top 2 benefit statements were confidence in data input and getting their maximum refund.

Taxes are a solitary chore. Although 52% of our sample was married or in a domestic partnership, only 30% said that choosing a tax software was a joint decision between them and their partner.

Gen Z and Millennials are more likely to use DIY tax software.

Females are more likely to use tax preparation services.

Click through to read the full article.

THE SOCIALLY TAXING

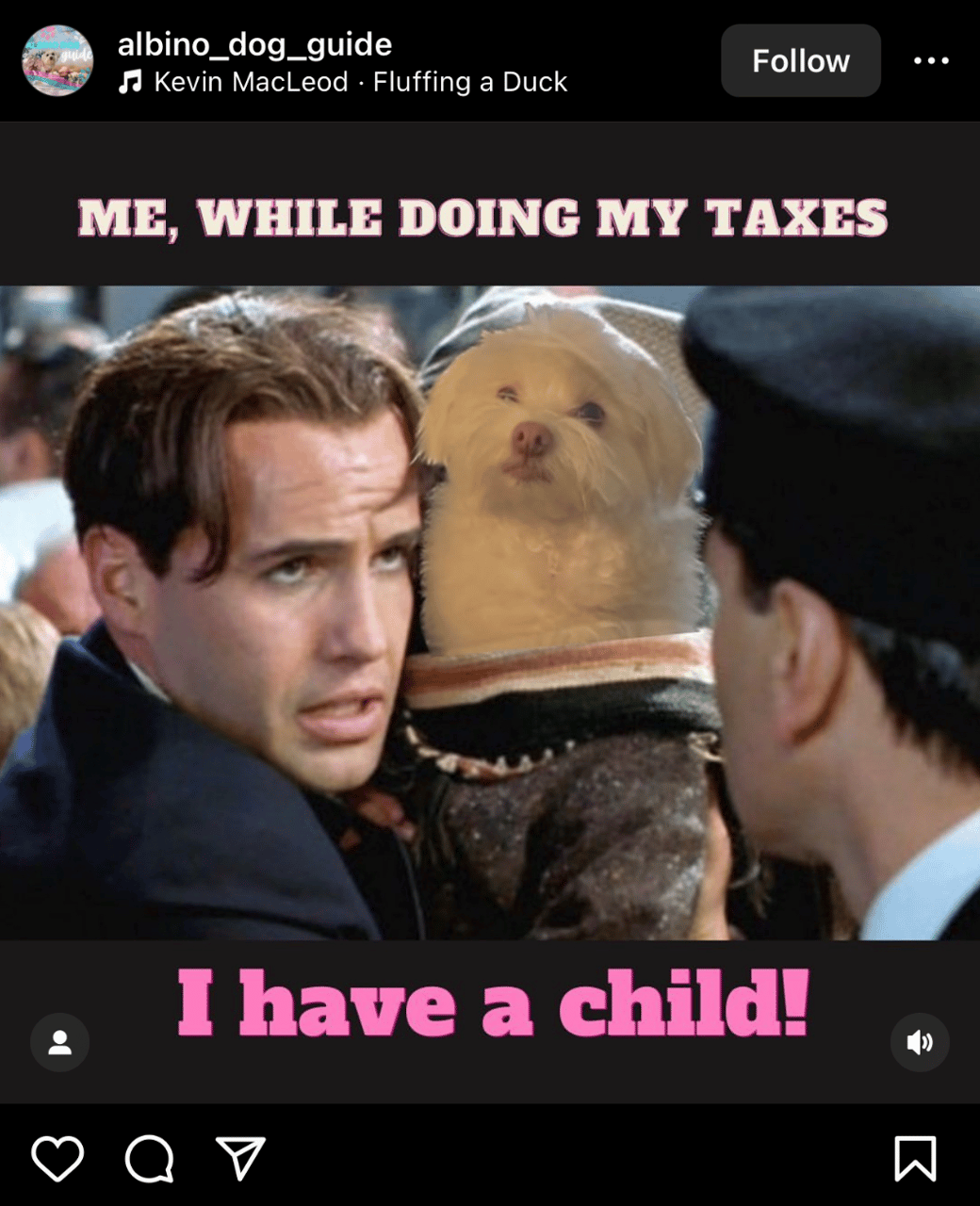

(source: @albino_dog_guide on Instagram)

This content is provided for informational purposes only and should not be construed as tax, legal, financial, or other professional advice. Rules and regulations vary by location and are subject to change, so please consult with an expert if you need specific advice. Copyright Disclaimer under section 107 of the Copyright Act of 1976, allowance is made for “fair use” for purposes such as criticism, comment, news reporting, teaching, scholarship, education, and research.

Tax Across the Web

Do you hear that sound? It's the sweet sound of progress, as the IRS unveils a new way to make our lives a little easier!

(source: Kate Dore, CFP | CNBC)

With an uptick in filing numbers and improvements in processing times, you could receive your refund sooner than expected. That's pretty good, considering filing numbers are up and refund numbers are down.

(source: Kelly Phillips Erb | Forbes)

With an uptick in filing numbers and improvements in processing times, you could receive your refund sooner than expected. That's pretty good, considering filing numbers are up and refund numbers are down.

(source: Rebecca Chen| Yahoo Finance)

Related Content

Related Content

Related Content

Related Content

There's more where this came from